Vuelvo a la escritura unos meses después, esta vez en español. Una pandemia, tipos de interés bajos y una cantidad de deuda enorme están en el día a día de muchos inversores. La vuelta de la inflación suena con fuerza en muchos analistas y esta quizás sea una de las mejores armas que tienen los bancos centrales para que el efecto en los montos de deuda que tienen muchos actores en la sociedad (y los propios BC) vayan disminuyendo. Otra forma que veo complicada es subir tipos y que medio occidente quiebre. Quizás sea un juego de largo plazo: hacer ruido con la inflación, dejar tipos bajos durante mucho más tiempo e ir viendo si subidas poco a poco (comenzando en 2022/2023) no hacen quebrar muchas inversiones.

Me gustó el tuit este:

En una entrevista de febrero de este año entre Howard Marks y Joel Greenblatt se preguntaban si estamos en una burbuja financiera. Para el bueno de Howard vivimos en tiempos optimistas, debido a las acciones de la Fed y el Tesoro americano debido al 2020 tan débil que hubo. En mi opinión, vivimos en tiempos optimistas desde hace ya bastantes años. Concretamente desde que se lanzó el QEinfinity. Hay que recordar que entre el 14 de febrero del 2020 y el 20 de marzo el S&P 500 perdió un 31,81% de su valor. Se produjo la mayor caída en el menor tiempo del que se tenían registros. El final lo conocemos todos: se produjo un rebote y el S&P 500 terminó el año en positivo. En parte debido a que las vacunas empezaban a aflorar su existencia y que en pocos meses los países desarrollados iban a tener acceso a ella y terminar así con la pesadilla.

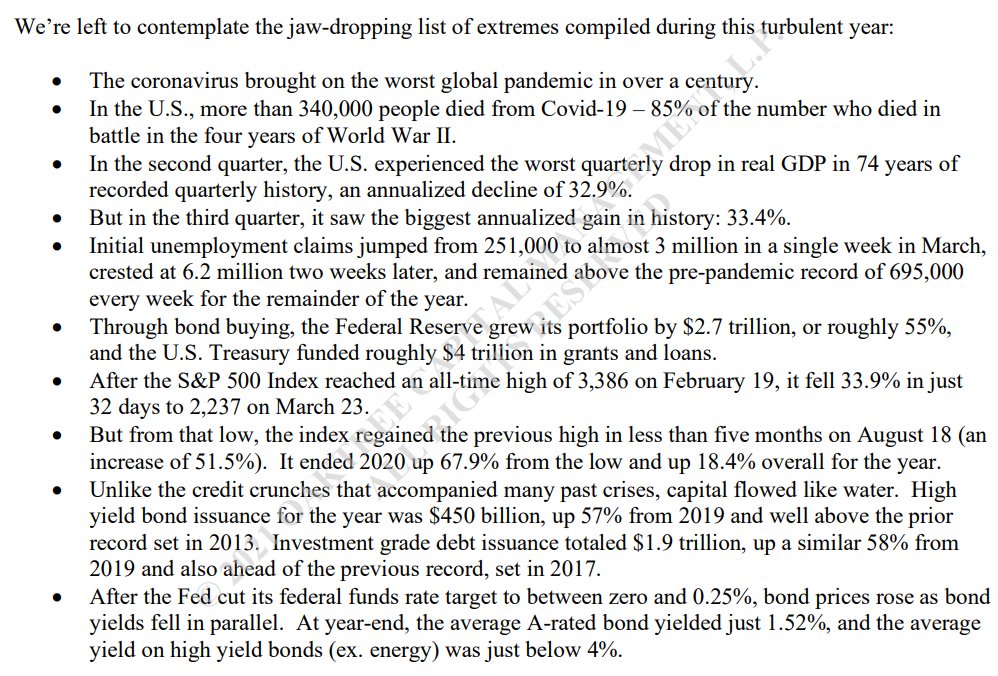

Que vivimos en tiempos con muchos extremos no es ninguna novedad. Aquí una serie de sucesos en los últimos meses que explican muy bien lo complicado de hacer previsiones y por tanto de poder invertir con unas hipótesis correctas. Sacado del memo de Howard, 2020 in review.

Otro gráfico interesante es el S&P 500 PE Ratio. Para el que no lo sepa, el PE Ratio o ratio PER en español. No es otra cosa que una división entre el precio y el beneficio por acción. La gráfica de abajo nos muestra el número actual al que cotiza el S&P 500.

¿Innovaciones financieras? La moda de las SPACs, la facilidad para empresas que no son rentables de salir a bolsa y el fenómeno de GameStop que puso un poco más de irracionalidad en el mercado. ¿Más irracionalidad en el mercado?

Howard comenta que las valoraciones relativas son razonables teniendo en cuenta las tasas de interés. Las valoraciones son mayores mientras más bajo sea el tipo de interés. Aquí, en los tipos de interés, esta vez si es diferente. ¿Cuántos de nosotros no hemos visto un 10% de tipos de interes? ¿Cuántos amigos se han comprado una casa con tipo fijo en los últimos años? La primera hipoteca de mis padres fue cercana al 15%, logicamente, el valor de los inmubles era muchísimo menor hacer 40 años que a día de hoy. La hipoteca de mi hermana es 1,75% fijo a 30 años. Como he dicho antes, esto sí es diferente. El coste del dinero a bajado porque así lo han querido los bancos centrales que tienen el poder para hacerlo.

Este coste del capital tiene un efecto sobre la valoración de todo tipos de activos, bien sean reales o financieros. Trato de hacer un ejemplo sencillo. Si yo invierto hoy 1.000 euros en un activo (una carretera con flujos estables), cuyo valor he obtenido descontando los flujos futuros que me van a pertenecer al 3%. De esos 1.000 euros me han prestado un 75%, y me he endeudado a un margen del 1,5% + EURIBOR (hoy en día muy bajo). El EURIBOR va a ir cambiando, a día de hoy los valores futuros serán muy bajos pero nada me garantiza que en 4 años el euribor no sea alto y mi margen + EURIBOR sea tan alto que mi inversión pase de ser positiva a negativa.

El descontar a día de hoy flujos futuros a una tasa equivocada o irreal va a provocar que en el futuro muchas inversiones no sean rentables y los inversores pierndan mucho dinero. Logicamente, en mi ejemplo anterior, tiene muchas matizaciones debido a que posiblemente mi inversión esté cubierto el riesgo inflación debido a que las tarifas de mi activo irán aumentando si la inflación aumenta. Sí, es correcto, pero a nivel de ejemplo creo que queda claro que mi ejercicio es teórico y que lo que trato de decir es que ser muy optimista en las hipótesis que tomamos va a llevar a desastres financieros.